What Is the VW Short Squeeze?

Short-sellers might then be triggered to buy the shares they had borrowed at a higher price, in an effort to keep their losses from mounting should the share price rise further. On October 26, 2008, Porsche announced a largely unexpected takeover plan for Volkswagen (VW). The resulting short squeeze in VW’s stock briefly made it the most valuable listed company in the world.

How has Ireland’s car market changed with a decade of two … – The Irish Times

How has Ireland’s car market changed with a decade of two ….

Posted: Wed, 12 Apr 2023 07:00:00 GMT [source]

However, it took weeks for VW stock to falter enough for most of the squeeze to have been returned to hedge funds at last. For example, traders who predict that a stock will drop in value can short sell it to benefit from its falling prices. When you short sell a stock, you borrow it from your broker at the prevailing interest rate and sell it in order to repurchase it later at a lower price.

We love the diversity of people, just like we like diversity in trading styles. We could charge more, but we have a pay it forward, give back mentality. We want to feel good about what we do, and the results and reviews speak for themselves. Our watch lists and alert signals are great for your trading education and learning experience.

Search all KU News

Under normal circumstances, the price of Volkswagen shares should be the same in each city, and indeed for most of the time this is confirmed empirically. This rule however can break down when limits to arbitrage arise such as reduced stock availability in the extreme market conditions of a short squeeze. During these times, the law of supply and demand can overrule the law of one price.

- Over the course of January 2021, Melvin lost a massive 53 percent of its assets under management.

- The stock price had gone from about $20 at the start of 2021 to more than $347 before the close of trading on Wednesday.

- Combined with the 20% stake the German government owned back then, it meant that less than 10% of the company’s float was actually available and accessible to traders and investors in the open market.

- We provide our members with courses of all different trading levels and topics.

- If the Volkswagen story tells us anything, it’s that market manipulation can come from both sides of the table.

- In this article, we’ll discuss what happened, explain what a short squeeze is, and how to search for potential short squeezes in the future.

The starting point for the short squeeze at that time was Porsche’s desire to accumulate more voting rights in Volkswagen. It did so by buying up VW shares in an effort to gain a greater foothold in the company, which at the time was a frequent but unrelated business partner. As Porsche started buying up VW shares, seeiking more voting rights and control of the board, VW stock price continued to inch up through 2006 and 2007, going from about €30 in 2005 to over €150 by 2007, seemingly absent any outside reason.

What happened in the Volkswagen short squeeze?

This disparity caused short sellers to rush to buy more stock to cover their positions, driving the stock price further through October 2008, with VW stock price now hovering just above €900 and exceeding €1,000 in intraday trading. In our paper, we provide a comparison of relevant regulations in the U.S. and Europe as well as an account of Porsche’s plan to take over Volkswagen. We also provide analyses of Porsche’s option strategies, margin requirements, and probability of default at the time, as well as detailed analyses of the short squeeze event and its impact on market quality and price discovery.

At one point during the 28 October session, the stock rose to €1,005, resulting in gains of 377% compared to the previous week’s closing price of €210.85 a share. Speaking on Volkswagen’s prospects, analysts at Morningstar admitted the company’s efforts to transition to zero-emission electric vehicles from internal combustion engines. As a result, on 18 March 2021, VOW stock rose to $357.4 a share.

Defining Characteristics of a High Short Interest Stock

Unfortunately, losses incurred from shorting can be infinite, compared to losses from buying, which can only go to zero. As unprecedented as the situation seems at the moment—and it is, since such coordination among retail investors has been rare—it’s similar to something that happened to Porsche Contrary opinion and Volkswagen more than a decade ago, though for different reasons. We put all of the tools available to traders to the test and give you first-hand experience in stock trading you won’t find elsewhere. The Bullish Bears trade alerts include both day trade and swing trade alert signals.

When looking at Volkswagen stock forecasts, it’s important to bear in mind that analysts’ predictions can be wrong. They are based on an analysis of the Volkswagen share price history. Past performance never guarantees future results.It’s important to do your own research. Your decision to trade depends on your attitude to risk, your expertise in the market, the spread of your portfolio and how comfortable you feel about losing money. Based on the stock’s average trading volumes, it would take traders 0.4 days to cover their open positions without necessarily prompting a surge in the price of VWAGY. You can use overbought indicators such as the RSI indicator or Stochastics indicator to determine if a stock is trending upward faster than its peers in the market.

The Volkswagen Short Squeeze

But Porsche was able to make huge sums of money, which is even more startling given how badly the automotive industry was doing at the time. “The classic pattern of past squeezes include a quick rise, and a quick fall,” said Lindsey Bell, chief investment strategist at Ally Invest. “Squeezed stocks can move violently for no reason, and the tide can turn quickly. And when the squeeze is done, everybody tries to sell at the same time.” So far for GameStop, the stock tumbled 30.8% to $225 apiece Monday from Friday’s close of $325. The shares dropped another 60% Tuesday, bringing their two-day losses to more than 70%.

The Porsche-VW squeeze of October 2008 is therefore an interesting and important short squeeze to study. The consensus of analyst reports at the time suggested that the voting stock of VW was expected to decrease to EUR 140 per share or less in the foreseeable future. In other words, VW’s ordinary stock was overvalued compared to its peers and consequently sold short by arbitrageurs. Given this environment, it was unlikely that VW’s ordinary shares would be staying at an overvalued level, with no fundamental data supporting these prices. Yet Porsche had effectively insured more than 50% of the voting stock of VW against falling stock prices by selling cash-settled put options. Liquidity and solvency analyses show that against the background of the credit crisis, Porsche lacked the funds to back up its contractual derivatives obligations that came under mounting pressure in October 2008.

According to data from MarketBeat, VWAGY’s short interest spiked in March this year but has progressively subsided. However, the number of shares that have been borrowed by traders is still exceeding pre-March levels. Data about https://investmentsanalysis.info/ the short interest of Volkswagen stock is not abundant, as the stock’s primary listing is on the Frankfurt Stock Exchange under the ticker symbol VOW and few websites provide this kind of information for German-listed shares.

“If we take a step back, we can differentiate between information-based stock manipulation and action-based stock manipulation. Both types were ruled out in the United States by the introduction of the Securities Exchange Act of 1934,” he said. “If we take a step back, we can differentiate between information-based stock manipulation and action-based stock manipulation. Both types were ruled out in the United States by the introduction of the Securities Exchange Act of 1934,” he said.

2017 Volkswagen Golf Alltrack Review & Ratings – Edmunds.com

2017 Volkswagen Golf Alltrack Review & Ratings.

Posted: Sun, 13 Nov 2016 21:36:09 GMT [source]

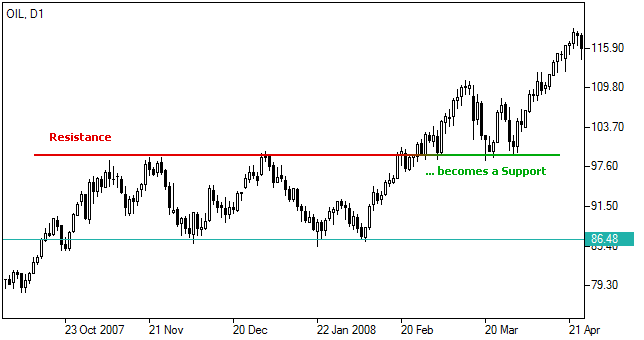

Although this “law” lacks a rigorous scientific proof, its argument is intuitive and powerful. Arbitrage opportunities exist whenever two or more identical securities trade at different prices, provided they can be traded without substantial cost. Rational traders will exploit these opportunities, and this process keeps the prices in check.

KU researchers share their expertise on today’s most pressing topics, including COVID-19. Tengulov and his co-authors spent months collecting data from court proceedings, translating it from German into English, then analyzing the results. Capital Com Online Investments Ltd is a limited liability company with company number B. Capital Com Online Investments Ltd is a Company registered in the Commonwealth of The Bahamas and authorised by the Securities Commission of The Bahamas with license number SIA-F245.