WW Stock Price WW International Inc Stock Quote U.S.: Nasdaq

Contents:

- WeightWatchers Latest Strategic Acquisition: Simplify Insurance Reimbursement For Costly Weight-Loss Drugs

- Investor Services

- Consolidated Communications, CRISPR Therapeutics And Other Big Stocks Moving Higher On Thursday

- Zacks Research is Reported On:

- The End Of Obesity: New Weight Loss Drugs Provide Hope To Those Overweight

WW International is one of the largest global providers of weight loss solutions, generating $1 billion in 2022 revenue. It boasts an active member base of 3-4 million, with a footprint that spans the United States, Canada, Europe, and a small presence in emerging markets . Shares Sold ShortThe total number of shares of a security that have been sold short and not yet repurchased.Change from LastPercentage change in short interest from the previous report to the most recent report. Exchanges report short interest twice a month.Percent of FloatTotal short positions relative to the number of shares available to trade. The big health and fitness focus seen through the Covid-19 lockdowns has eased, impacting demand for weight management services.

This is an increase of 33% compared to the previous 30 days. 46 people have searched for WW on MarketBeat in the last 30 days. This is an increase of 70% compared to the previous 30 days. WW International does not have a long track record of dividend growth. WW International has only been the subject of 3 research reports in the past 90 days. WW International Inc. , or WeightWatchers, said late Wednesday that Chief Financial Officer Amy O’Keefe will leave her role effective Friday but remain with the company until Dec. 31 “to support the finance team for the re…

Markets Today: Stock Index Futures Climb on Meta’s Earnings – Barchart

Markets Today: Stock Index Futures Climb on Meta’s Earnings.

Posted: Thu, 27 Apr 2023 13:00:00 GMT [source]

You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security. ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. Provide specific products and services to you, such as portfolio management or data aggregation. WW International issued an update on its first quarter 2023 earnings guidance on Monday, March, 6th. The company issued revenue guidance of $235.00 million-$235.00 million, compared to the consensus revenue estimate of $243.89 million.

WeightWatchers Latest Strategic Acquisition: Simplify Insurance Reimbursement For Costly Weight-Loss Drugs

The Motley Fool has positions in and recommends Goldman Sachs Group. Shares of WeightWatchers’ parent have been soaring after multiple analysts’ upgrades. If you have RSS reader, Please Cut and Paste the URL /data/xml/notices.xml in your RSS Reader.

Realtime quote and/or trades are not sourced from all markets. “Murder” seems to be a common theme on the Netflix top 10 charts these days, with Dahmer becoming one of the service’s most popular series ever, and The Watcher in the #1 spot currently. The best smart scales do more than tell you your weight—they give you in-depth data about your overall health and fitness. Excitement continues to build for a new drug that is expected to gain FDA approval for weight loss as early as this year. Manufactured by Eli Lilly, tirzepatide has a dual effect in lowering body fat and normalizing blood sugar levels.

Investor Services

We expect earnings to come in at about $0.37 per share, slightly ahead of consensus estimates of $0.36 although this would mark a significant decline from Q when earnings stood at almost $0.65 per share. WW International published a tough set of Q results earlier this month, with both revenues and earnings missing estimates. Highlights important summary options statistics to provide a forward looking indication of investors’ sentiment. The Barchart Technical Opinion rating is a 88% Buy with a Strongest short term outlook on maintaining the current direction. The market continues to seek direction, but the MarketBeat analysts are helping you find opportunities.

One share of WW stock can currently be purchased for approximately $8.26. 81.10% of the stock of WW International is held by institutions. High institutional ownership can be a signal of strong market trust in this company. 12 people have added WW International to their MarketBeat watchlist in the last 30 days.

Verify your identity, personalize the content you receive, or create and administer your account. By creating a free account, you agree to our terms of service. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. MarketBeat has tracked 7 news articles for WW International this week, compared to 5 articles on an average week.

Consolidated Communications, CRISPR Therapeutics And Other Big Stocks Moving Higher On Thursday

They rarely distribute dividends to shareholders, opting for reinvestment in their businesses. More value-oriented stocks tend to represent financial services, utilities, and energy stocks. These are established companies that reliably pay dividends. However, the big problem with these weight-loss treatments has been that demand has surpassed supply, which is why people have been using Ozempic even though it’s not approved for weight loss. It’s not necessarily an issue that people can’t obtain prescriptions, but that the actual drugs are not available. But that’s not something that will exclusively benefit Sequence or WeightWatchers.

Late-stage trials suggest Lilly’s tirzepatide, sold under Mounjaro, could be a more effective obesity drug that Ozempic or Wegovy, and the company expects a regulatory decision by the end of the year. The big reason for the bullishness from some analysts is that WW International recently closed on an acquisition for Sequence, which runs a subscription telehealth platform. Founded in 1993 by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services.

This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.27% per year. These returns cover a period from January 1, 1988 through April 3, 2023. Zacks Rank stock-rating system returns are computed monthly based on the beginning of the month and end of the month Zacks Rank stock prices plus any dividends received during that particular month. A simple, equally-weighted average return of all Zacks Rank stocks is calculated to determine the monthly return. The monthly returns are then compounded to arrive at the annual return.

There may be delays, omissions, or inaccuracies in the Information. The aggregate demand with the best average Zacks Rank would be considered the top industry , which would place it in the top 1% of Zacks Ranked Industries. The industry with the worst average Zacks Rank would place in the bottom 1%. An industry with a larger percentage of Zacks Rank #1’s and #2’s will have a better average Zacks Rank than one with a larger percentage of Zacks Rank #4’s and #5’s. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time.

The P/E ratio of WW International is -2.33, which means that its earnings are negative and its P/E ratio cannot be compared to companies with positive earnings. In the past three months, WW International insiders have not sold or bought any company stock. MarketRank is calculated as an average of available category scores, with extra weight given to analysis and valuation. WW International is poised to report its Q results on November 3.

Zacks Research is Reported On:

WW International’s stock was trading at $3.86 on January 1st, 2023. Since then, WW shares have increased by 114.0% and is now trading at $8.26. WW International has a short interest ratio (“days to cover”) of 1.5, which is generally considered an acceptable ratio of short interest to trading volume. According to analysts’ consensus price target of $6.80, WW International has a forecasted downside of 18.6% from its current price of $8.35. WW International stock has outperformed significantly this year, rising by about 62% since early January.

Sumitomo Mitsui DS Asset Management Increases Stake in W.W … – Best Stocks

Sumitomo Mitsui DS Asset Management Increases Stake in W.W ….

Posted: Sat, 08 Apr 2023 07:00:00 GMT [source]

This exchange-traded fund rebalances into stocks as they become cheaper relative to their fundamentals. One silver lining of the bear market is half the stocks followed by Morningstar analysts are now undervalued. Morningstar Quantitative ratings for equities are generated using an algorithm that compares companies that are not under analyst coverage to peer companies that do receive analyst-driven ratings. WW International’s stock is owned by many different institutional and retail investors.

WW International dropped by close to 25% in Wednesday’s trading, after the company published a weaker than expected set of Q earnings and provided a tough outlook for the rest of the year. While quarterly revenues declined by about 6.5% year-over-year to $311 million, reported EPS fell… The stock has been on a weak footing for some time now, as the company’s digital business, which relies on mobile apps to provide services and proved a big driver of the stock’s rally through the pandemic, witnesses declines. WW International announced that it would acquire digital health company Sequence for a net consideration of about $106 million, as it looks to enter the increasingly popular obesity drug market. Represents the company’s profit divided by the outstanding shares of its common stock.

The End Of Obesity: New Weight Loss Drugs Provide Hope To Those Overweight

In comparison, the S&P 500 is up by just about 15% over the same period. The company has seen robust growth in its Digital business through the pandemic… WW International stock has declined by close to 40% year-to-date to levels of around $10 per share, with the stock now trading at almost 75% below its 2021 highs. Investors started valuing WW as a technology stock, as it posted big growth in…

For US and Canadian Stocks, the Overview page includes key statistics on the stock’s fundamentals, with a link to see more. Provides a general description of the business conducted by this company. Even a few weeks of reducing the amount of time young people spend on social media – such as Facebook, Instagram, TikTok and Snapchat – can make a significant difference to their body image. All values as of most recently reported quarter unless otherwise noted. David Jagielski has no position in any of the stocks mentioned.

- And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

- As of April 15th, there was short interest totaling 10,340,000 shares, an increase of 80.8% from the March 31st total of 5,720,000 shares.

- For US and Canadian Stocks, the Overview page includes key statistics on the stock’s fundamentals, with a link to see more.

- Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management.

- “Murder” seems to be a common theme on the Netflix top 10 charts these days, with Dahmer becoming one of the service’s most popular series ever, and The Watcher in the #1 spot currently.

Top institutional shareholders include Simplex Trading LLC (0.00%). Insiders that own company stock include Amy Kossover, Christopher J Sobecki, Corinne Pollier-Bousquet, Denis F Kelly, Michael F Colosi, Oprah Winfrey and Sima Sistani. WW International stock posted a weak set of Q results earlier this month, as the big health and fitness focus seen through the Covid-19 lockdowns continues to cool off with people heading back outdoors. The broader markets have seen some gains over the past month, with the S&P 500 up almost 3% driven by signs of cooling inflation and expectations of more moderate rate hikes by the Federal Reserve. Live educational sessions using site features to explore today’s markets.

Down 75% This Year, What’s Next For WW International Stock?

Zacks Earnings ESP looks to find companies that have recently seen positive earnings estimate revision activity. The idea is that more recent information is, generally speaking, more accurate and can be a better predictor of the future, which can give investors an advantage in earnings season. The scores are based on the trading styles of Value, Growth, and Momentum. There’s also a VGM Score (‘V’ for Value, ‘G’ for Growth and ‘M’ for Momentum), which combines the weighted average of the individual style scores into one score. Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view.

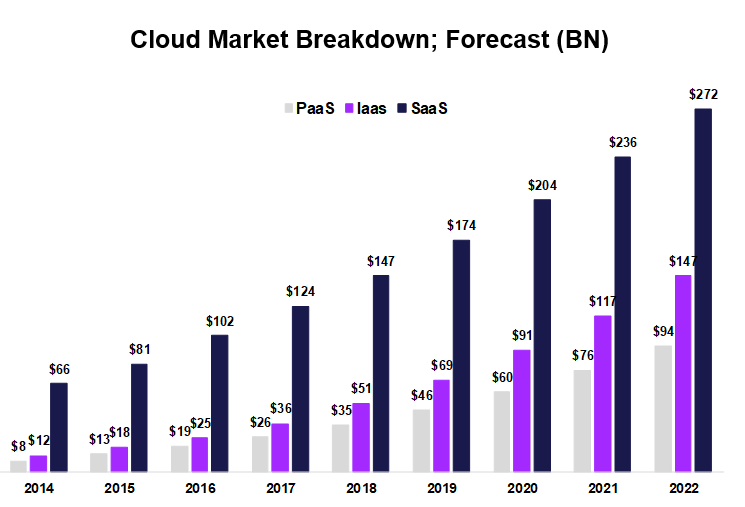

Our investment management business generates asset-based fees, which are calculated as a percentage of assets under management. We also sell both admissions and sponsorship packages for our investment conferences and advertising on our websites and newsletters. The company’s products and services are comprised of nutritional, activity, behavioral and lifestyle tools and approaches. It operates primarily in North America, Continental Europe, United Kingdom and Other. High-growth stocks tend to represent the technology, healthcare, and communications sectors.

This score is calculated as an average of sentiment of articles about the company over the last seven days and ranges from 2 to -2 . This is a lower news sentiment than the 0.58 average news sentiment score of Consumer Discretionary companies. The company’s average rating score is 2.20, and is based on 2 buy ratings, 2 hold ratings, and 1 sell rating.

We’d like to share more about how we work and what drives our day-to-day business. A stock’s beta measures how closely tied its price movements have been to the performance of the overall market. Morningstar analysts hand-select direct competitors or comparable companies to provide context on the strength and durability of WW’s competitive advantage. © 2023 Market data provided is at least 10-minutes delayed and hosted by Barchart Solutions.

Earlier this week, Goldman Sachs changed its price target for WW International from $3.80 to $13. That’s more than three times what the stock was trading at. Davidson, set a more modest price target of $9 on Thursday, but it, too, is bullish on the company’s prospects. Analyst price targets typically look at a period of 12 months, so in the long run these analysts may expect even more upside for WW International. We sell different types of products and services to both investment professionals and individual investors. These products and services are usually sold through license agreements or subscriptions.

Money Flow Uptick/Downtick https://1investing.in/Money flow measures the relative buying and selling pressure on a stock, based on the value of trades made on an “uptick” in price and the value of trades made on a “downtick” in price. The up/down ratio is calculated by dividing the value of uptick trades by the value of downtick trades. Net money flow is the value of uptick trades minus the value of downtick trades. Our calculations are based on comprehensive, delayed quotes. One of the dangers of jumping in early is that’s far too soon to tell how big of an effect this acquisition will have on WeightWatchers’ business. When WW announced plans to acquire Sequence, it noted that the telehealth company was generating a run rate of just $25 million in annual revenue.