Trading a rising or falling wedge pattern

Contents:

Investopedia does not provide tax, investment, or financial services and advice. Investing involves risk, including the possible loss of principal. These formations are relatively rare during normal market conditions over the long term, since most markets tend to trend in one direction or another over time. Topics such as geopolitical conflict or a change of direction in Fed policy, or especially a combination of the two, are likely to coincide with such formations. The list of chart pattern analysts is long and chart patterns have been around for decades.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Spot Gold and Silver contracts are not subject to regulation under the U.S. Contracts for Difference are not available for US residents. Before deciding to trade forex and commodity futures, you should carefully consider your financial objectives, level of experience and risk appetite. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to Forex.com or GAIN Capital refer to GAIN Capital Holdings Inc. and its subsidiaries.

This alone was a red flag that the entry method wasn’t going to offer us a favorable enough risk to reward. The NZDUSD chart below illustrates where I set my take profit and why. Instead, we’re entering short as soon as we have a confirmed breakout. Pullbacks into the pattern after breakout do occur regularly so place your stops accordingly.

Falling Wedge Pattern: What To Do If It Appears On A Crypto Chart? – CoinGape

Falling Wedge Pattern: What To Do If It Appears On A Crypto Chart?.

Posted: Sat, 25 Feb 2023 11:43:05 GMT [source]

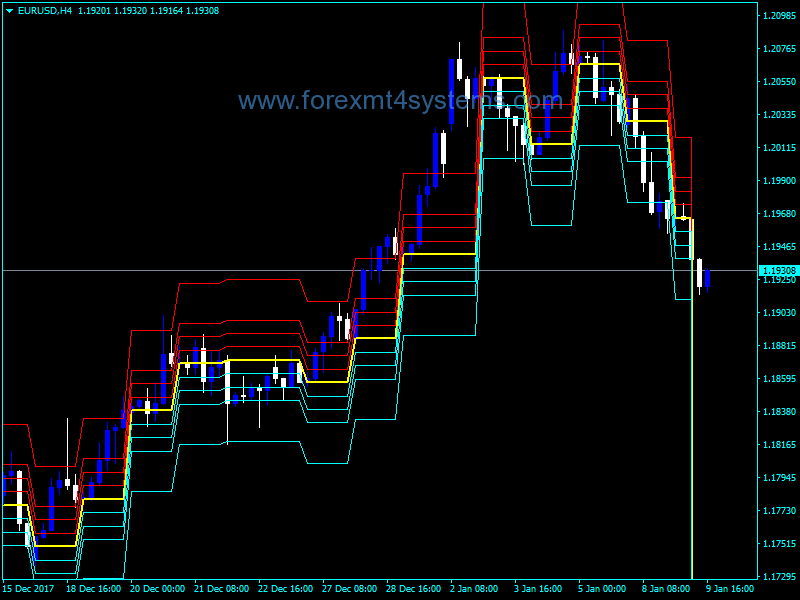

When rising broadening wedge pattern rises off the lower trendline, and doesn’t reach the upper trendline before falling back to the lower trendline. Finally, we have a breakout to the downside, as the buyers were unable to capitalize on the positive momentum they had. This wedge is a bit narrower as two trend lines converge quite quickly, which is positive from the risk/reward perspective. A rising wedge is almost always bearish, however, in certain conditions a rising wedge can break bullish. For example, if the pattern becomes too obvious to the market, a crowded trade could provide the opportunity for a short squeeze and a large rally. After a valid rising wedge completes, either an uptrend has ended or a downtrend is set to continue.

Is a Rising Wedge Bullish or Bearish?

The trend lines drawn above the highs and below the lows on the price chart pattern can converge as the price slide loses momentum and buyers step in to slow the rate of decline. Before the lines converge, the price may breakout above the upper trend line. A rising wedge is often considered a bearish chart pattern that points to a reversal after a bull trend. A rising wedge is believed to signal an imminent breakout to the downside.

- https://g-markets.net/wp-content/uploads/2021/09/image-5rvp3BCShLEaFwt6.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-NCdZqBHOcM9pQD2s.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/male-hand-with-golden-bitcoin-coins-min-min.jpg

- https://g-markets.net/wp-content/themes/barcelona/assets/images/placeholders/barcelona-sm-pthumb.jpg

This question will fetch a variety of answers depending on your strategy, time frames utilized, risk to reward and several other factors. Also, one thing you’ll find when you make the transition to a higher time frame is that false breaks become a rarity, at least compared to a 5 or 15-minute chart. If it doesn’t match up with one of these areas, I’ll choose the closest support or resistance level without exceeding the measured move. While not an exact science, as you can see from the NZDUSD chart above, this method of finding a profit target can be very useful.

What is a Broadening Wedge?

Shortly after closing below support the pair declines by 104 pips, which is the profit potential that we’re after. Furthermore, there are attributes about the broadening wedge including its measured objective that differ from a narrowing pattern, which often confuses traders. Your target for profit is the height of the wedge at breakout. Watch out for nearby support and resistance, make this your first target.

Once a side is chosen, it makes the investor or https://g-markets.net/r bearish or bullish.. Bulls get the name from goring upward with their sharp horns, while bears swat downward with their fierce claws. In this first example, a rising wedge formed at the end of an uptrend. Wedges can serve as either continuation or reversal patterns. I wish you to be healthy and reach all your goals in trading and not only!

Setting Profit Targets with Measured Objectives

Please read Characteristics and Risks of Standardized Options. The broadening wedge pattern is a type of wedge that looks a bit different to the ascending and descending variants. Instead of pointing towards each other, the support and resistance lines diverge – hence the ‘broadening’ in the name. In a rising wedge, both boundary lines slant up from left to right. Although both lines point in the same direction, the lower line rises at a steeper angle than the upper one. Prices usually decline after breaking through the lower boundary line.

If it breaks out through support instead, the pattern has failed. With the best trading courses, expert instructors, and a modern E-learning platform, we’re here to help you achieve your financial goals and make your dreams a reality. Volume levels will then rise significantly upon a breakout . When trading this pattern, it is also important to keep an eye on the volume levels.

The falling broadening wedge can be bullish, bearish or neutral, depending on the direction of the breakout. A symmetrical triangle is a chart pattern characterized by two converging trendlines connecting a series of sequential peaks and troughs. Prices will immediately return to the lower trend-line and normally head lower, breaking towards the downside.

If there is a lot of “white space” in the pattern then it will be tricky to identify. Tall and wide patterns work better than short and narrow patterns. During the pattern’s formation, there are a few indicators that can be used to determine whether the pattern is a real pattern or a disguise. You can also check how both of these approaches work by opening trades on the demo account, which you can do here.

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/09/image-KGbpfjN6MCw5vdqR.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

Alternatively, you can practise trading wedges with a cost-freeFOREX.com demo account. You’ll get full access to our platform, preloaded with virtual funds. So, you can test out your wedge trading strategy with zero risk. You might also want to consider setting a limit order at your profit target. You can use the height of the wedge to give you an idea of the possible size of the resulting move. This is when the price breaks out of the wedge in one direction, only to reverse and move back inside the wedge.

How to Draw Trend Lines Perfectly Every Time

We’ll also provide tips on how to prepare for the rare event where a rising wedge has a bullish breakout. Technical analysis patterns come in various shapes and sizes, with some being more bullish or bearish, while others are neutral. Few trading patterns are as easy to identify and trade as the rising wedge pattern.

This pattern has a rising or falling slant pointing in the same direction. It differs from the triangle in the sense that both boundary lines either slope up or down. Price breaking out point creates another difference from the triangle.

The PCE Report Could Provide Fireworks For The Market- The Week of February 21, 2023 Edition – Monster Stock Market Commentary

The PCE Report Could Provide Fireworks For The Market- The Week of February 21, 2023 Edition.

Posted: Mon, 20 Feb 2023 08:00:00 GMT [source]

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. As this historical example shows, when the breakdown does happen, the subsequent target is generally achieved very quickly. Full BioSuzanne is a content marketer, writer, and fact-checker.

The upper trend line of an ascending broadening wedge goes upward at a higher rate than the lower one, thus creating an apparent broadening appearance. The ascending broadening wedge formations volume is likely to increase ever so slightly as the breakout advances. The ascending broadening wedge is a chart pattern that tends to disappear in a bear market. Most often, you’ll find them in a bull market with a downward breakout.